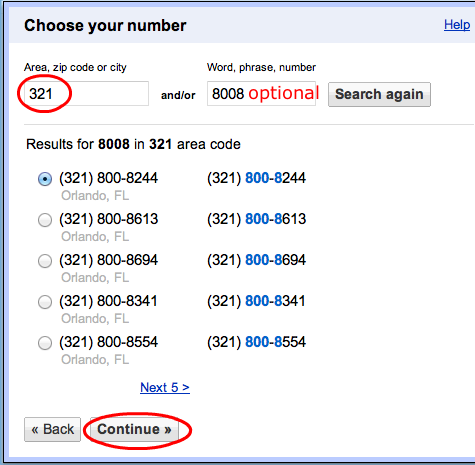

Should I have a New York City number or a toll free number? Please check your existing local New York City numbers for coverage and make sure that your local numbers are eligible for transfer before proceeding. The local New York City number you wish to transfer must be within our coverage area. You can check for specific availability in New York City on our site, or give us a call and we can try and help you locate the number you are looking for.Ĭan I transfer my New York City telephone number to Grasshopper? We offer local numbers in many markets throughout the US. Get a New York City phone number from Grasshopper today and get connected!ĭo you have all New York City area codes available? Forward calls to any number you would like and enjoy all of the great features we offer Call forwarding, unlimited extensions, custom greetings and more. Grasshopper has local numbers for many states and cities including New York City, that can be used with our virtual phone system. If you’re having tax problems because of financial difficulties or immediate threat of adverse action and you haven’t been able to resolve them with the IRS, the Taxpayer Advocate Service (TAS) may be able to help you.Local New York City phone numbers can give your small business a multi-city feel or your big business a local feel. For more information, see Volunteer Income Tax Assistance and Tax Counseling for the Elderly. IRS offices are closed on federal holidays.Ĭertain taxpayers may qualify to get free tax return preparation and electronic filing help at a location near where they live. Then, call 84 to schedule an appointment. Once you find your local office, see what services are available. You can find the office closest to you with our Taxpayer Assistance Locator tool.

The IRS is committed to protecting against further spread of COVID-19, and we encourage people to use this self-screening tool prior to visiting IRS facilities. This tool is for optional use by IRS employees, taxpayers, tax professionals and others prior to entering an IRS facility. To help protect taxpayers and employees, the COVID-19 Screening Tool is available for people to self-screen for symptoms. Appointment times vary by tax issues and office locations. You can make an appointment at an IRS local office to get help. Requesting a face-to-face meeting for help Please note, our local offices provide assistance only on specific topics.

PHONE NUMBERS PROFESSIONAL

If you can't find the answers to your tax questions on IRS.gov, we can offer you help in more than 350 languages with the support of professional interpreters. Phone lines in Puerto Rico are open from 8 a.m. Residents of Alaska and Hawaii should follow Pacific time. Our help lines are open Monday through Friday. Telephone service wait times are generally higher on Monday and Tuesday.Some telephone service lines may have longer wait times. Telephone service wait times can average 19 minutes.Telephone service wait times are higher on Monday and Tuesday, during Presidents Day weekend and around the April tax filing deadline.Telephone service wait times can average 13 minutes.Court approval letter or our IRS Form 56, Notice Concerning Fiduciary Relationship (for estate executors).Third parties calling for a deceased taxpayer Preparer tax identification number or personal identification number.Valid Form 8821, Tax Information Authorization or Form 2848, Power of Attorney and Declaration of Representative.Verbal or written authorization to discuss the account.Filing status – single, head of household, married filing joint, or married filing separate.Individual Taxpayer Identification Number (ITIN) for taxpayers without a Social Security number.Social Security numbers (SSN) and birth dates.Our representatives must verify your identity before discussing your personal information. Telephone assistors can help with many topics but see the list of topics our assistors can’t address. Are your Social Security benefits taxable?.Are your unemployment benefits taxable?.Use our Interactive Tax Assistant to answer your tax-related questions, such as: Get the latest information on IRS operations and services. Do not file a second tax return or call the IRS. We’re processing all mail in the order we receive it. It’s taking us longer to process mailed documents including paper tax returns. To get your AGI quickly, order a tax transcript online or access your Online Account. Note: You can’t get your AGI over the phone. Sign your e-filed return with your adjusted gross income (AGI).E-file options for individual taxpayers.Individual Taxpayer Identification Number (ITIN)įile an accurate return and use e-file and direct deposit to avoid delays.

0 kommentar(er)

0 kommentar(er)